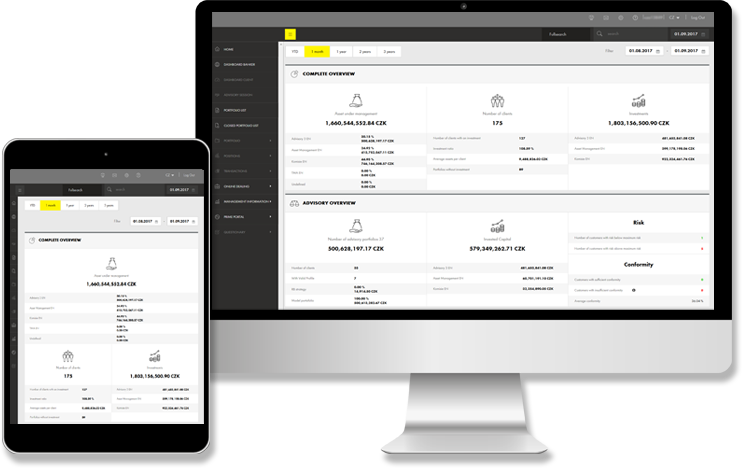

Assets administration via web

We developed the AMS-WEB software platform for investment banking and online investment services. With its second generation graphical interface, it is currently implemented for banks with affluent and retail clients, investment (management) companies and securities dealers for a distribution network with more than 1200 financial agents. It integrates advisory, analytical tools, investment product sales, automated robo-advisory and fully contactless onboarding of new clients. AMS-WEB will be appreciated by a wide range of users, from private bankers, client personnel, financial advisors to distribution network intermediaries and end clients.

It is natively integrated with the core Asset Management Suite (AMS) product but AMS-WEB also works as a web layer on top of third party core systems. We will customize this "white label" product to your corporate identity and tailor the workflow to your desired business objectives.

Information available for user

- Actual and historical asset values including analysis of capital employed

- Portfolio analysis with asset allocation by countries, branches and currencies including fund-in-fund drill down

- Absolute and relative performance calculation including benchmark comparison and many additional key performance indicators

- Representation of all historical transactions based on security, money market and foreign exchange transactions

- Representation of all historical account transaction including details

- Consolidation of several portfolios (e.g. of all family members)

- Credit and loan contract information including account balances and historical interest rates

- Representation of all transaction volumes, total number of managed portfolios, list of accounts, accumulative turnower

Customer valuation

"The onboarding process in the delivered system gives us the opportunity to effectively gain clients and cover their requests for investment financial services. Our team enjoys the advantage of having FINAMIS as a supplier and IT partner all throughout production when our technical support requests are taken care of as needed using a flexible approach."

Director of PARTNER INVESTMENTS, o.c.p., a.s., 2020

Functionality and Properties

- Complex portfolio analysis

- Integrated risk management

- Order management

- Conform GUI integration to clients Corporate Identity environment

- One button export to Excel or PDF

- Individual customized reporting

- 24/7 access to portfolios

- Responsible design for tablets and smart phones

- Presentation mode - allows compatibility with third-party systems via interfaces

- Scalable modular architecture allows to serve large FSIs as well as smaller ones

- Suitable for companies /depatrments with different services (private banking dept., investment, fund or asset management companies, brokerage firms)

Main Modules

Portfolio Information

Portfolio Information provides a clear overview of assets, asset performance, including various additional key performance indicators, historical transactions, capitalized income value analysis, country-, currency- and branch allocation analysis. Full, extensive and comprehensive information not only for your security portfolio

Management Information

for your distribution channel partner business or outsourced portfolio management business the AMS-WEB Management Information provides unlimited hierarchical consolidation levels which represents detailed information for each level and special customized order functionality (integrated with AMS-WEB Order Management)

Risk manager

check and evaluate with the taken risk of a portfolio via Value-at-Risk calculation. Drill down each portfolio position in the value-at-risk calculation and analyze the proportional risk. Define and run simulations to analyze possible market scenarios or portfolio optimization impacts

Order Management

orders can be placed during the customer investment advice meeting or automatic via collective orders for effective portfolio rebalancing. The order settlement is guaranteed based on position and investment profile checks and represented in an clear and comprehensive open order position overview

Report Generator

provides off line report generation for any information provided by AMS-WEB Portfolio Analyzer. All reports are saved and updated with current information. This guarantees quick retrieval in preparation for your next customer meeting, and allows simplify and automate regular reporting

Demo AMS-WEB

Get an idea of AMS-WEB through our public demo. We mark-to-market more than 1,000 sample investment portfolios. We display a variety of parameters such as portfolio performance, asset value to invested capital comparison, asset overview, asset allocation, risk level and other attributes.

Public account

You can easily explore the open AMS-WEB preview using public access. Open our Tutorial and follow the step-by-step instructions described.

Individual account

We can also offer you an individual test account upon request, where you can get even better acquainted with the application's options, configure the site, and choose your preferred language. Send us a registration email and we will create an individual user account for you immediately.

| Email: | office(at)finamis.com |

| Subject: | Individual user |

Please include the following information in your message:

your first name, last name:

valid email:

company name:

special comment or requirements

What is AMS-WEB: Broker used for?

It is functionally based on AMS-WEB® application. Moreover, it supports active trading in real time. through a direct interconnection to a financial portal, it is able to react really flexible to investment possibilities, without any need to contact bank workers. The application core provides a complex administration of investment portfolios such as registering, reporting, and fees.

AMS-WEB:Broker offers synergy to operators as well as final clients.

- Rising the competitiveness of the operator

- Simple integration with existing systems of the third parties

- Access of clients from various types of final devices (PC, tablet, smart phone)

- Scale distribution – selection for beginning investors, full functionality for those who trade intensively

AMS-WEB© | AMS-WEB:Broker | |

| Placing orders | ||

| Near a real time quotation/price from markets | ||

| Management, administration support, charging of providing near and real time prices based on the contract with final clients | ||

| Minimalization of application response, scale, load balancing in accordance with number of users trading in parallel | ||

| Orders overview | ||

| Real time interface for investment accounts | ||

| Direct connection to trading system of stock exchange or through a partner in the role of broker | ||

| Integration with financial portal |

| Reference Raiffeisenbank a.s., ČR - financial portalFINAMIS has developed and implemented for Raiffeisenbank, a.s. a portal solution with automatized interconnection for registered clients to trading. Financial portal is implemented in cooperation with salesXp GmbH Vienna and with a product Prime Portal. |

Implemented solution

* RBroker is a trade name used for AMS-WEB: Broker by a specific client